Fortune published a piece this week with a headline that got a lot of people talking: "Thousands of CEOs just admitted AI had no impact on employment or productivity — and it has economists resurrecting a paradox from 40 years ago."

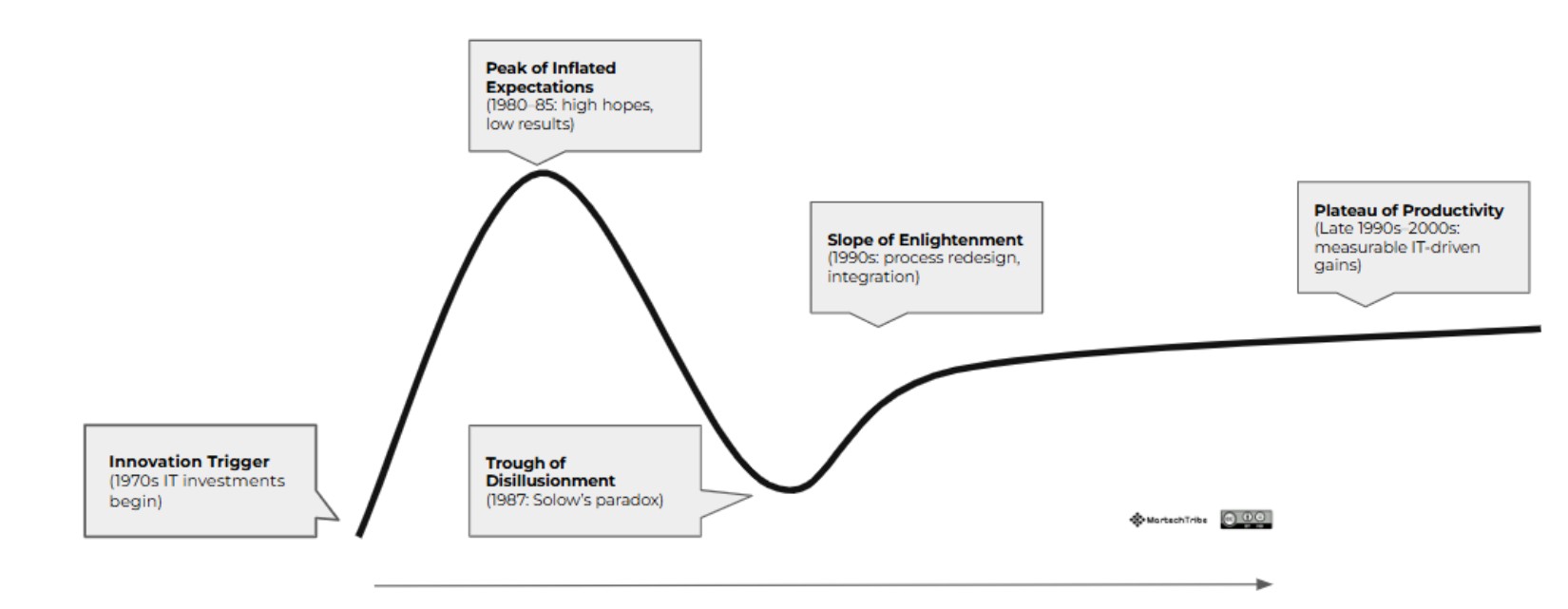

The article covers a new study from the National Bureau of Economic Research that surveyed 6,000 C-suite executives across the U.S., UK, Germany, and Australia. Nearly 90% of firms reported AI has had no measurable impact on employment or productivity over the past three years. A quarter aren't using AI at all. Those who are average about 90 minutes per week with it. Economists are drawing parallels to Solow's Productivity Paradox from the 1980s, when companies poured money into information technology and got nothing but reams of reports nobody read.

It's a compelling narrative. But from where we sit in oil and gas, the story is more complicated than the headline suggests.

In Our Industry, AI Is Already Delivering

The 90% stat comes from a cross-industry survey. When you zoom into upstream oil and gas, the picture looks different.

At the 2025 CERAWeek conference, Devon Energy reported a 25% boost in well productivity driven by AI. Seeking Alpha went as far as calling Devon "an oil company with an AI obsession," noting that AI-driven gas lift optimization is delivering 3–5% production uplifts and reducing capex through outsourced compression.

BP reported that between 2022 and 2024, AI and advanced analytics increased operated production by around 4% and protected roughly 10% more from going offline through real-time surveillance and monitoring.

ExxonMobil is leveraging AI to target $15 billion in operating cost reductions by 2027, with autonomous drilling systems already running offshore Guyana.

These aren't speculative pilots. They're measurable results showing up in investor presentations and earnings calls. So when we hear "90% of firms see no impact from AI," our instinct is to push back. In this industry, the operators who've deployed AI with discipline and clear goals are seeing real returns.

But Here's the Caveat

The operators making headlines — Devon, BP, ExxonMobil — are large, well-resourced companies with dedicated technology teams. Across the broader industry, we simply don't have full visibility into what every operator is doing with AI internally. Every company is at a different stage, tackling different challenges, with different levels of resources.

What we do know is where the results end up. Regardless of what's happening in the field or in a company's internal workflows, the data ultimately lands in the same places — accounting systems, production databases, revenue platforms, financial reporting tools. Those are the systems of record. That's where production meets financials, where actuals meet forecasts, and where the numbers that drive capital allocation decisions take shape.

And for most operators, connecting those systems — getting a clean, timely, unified view across them — is still a largely manual process.

The Spending Is Real — and Growing

The numbers confirm the industry's commitment to AI. Deloitte's 2026 Oil and Gas Industry Outlook projects AI spending by U.S. oil and gas companies will jump from roughly $4 billion in 2025 to $13.4 billion by 2029. AI currently makes up less than 20% of total IT spending in the sector but is expected to surpass 50% by the end of the decade.

Upstream accounts for about 61% of AI investment in oil and gas, with predictive maintenance leading at nearly 38% of current spend.

That investment is producing results in the field. But the management layer — the connective tissue between operational data, accounting systems, and executive decision-making — hasn't received the same attention. Not because the work isn't happening at the operational and accounting level, but because integrating across those systems hasn't been a priority in the same way.

That's Where Tauris-AI Sits

We don't claim to know what's happening inside every operator's workflows. We don't need to. We know where the data lives, and we integrate the systems where the results end up.

Tauris-AI is an orchestration layer that sits above operations and accounting, connecting the systems of record so management has a unified, timely view of the business. Your teams keep doing their work. Your systems stay in place. Tauris-AI ties them together.

The Paradox Isn't About AI. It's About Integration.

We'd defend our industry against the 90% headline. Oil and gas operators have proven that AI delivers when it's deployed with discipline against defined problems. The results from Devon, BP, ExxonMobil, and others aren't anecdotal — they're showing up in production numbers and cost savings.

But the work happening across operations and accounting doesn't automatically translate into a connected view for the people making capital allocation decisions. The data lands in systems. Those systems don't always talk to each other. And bridging that gap is still, for most operators, a manual process.

The AI productivity paradox isn't a technology problem. It's an integration problem. The operators that connect the systems where their results already live will be the ones that close the gap — not by doing more work, but by making the work they're already doing visible, timely, and actionable at the management level.

Sources:

- Thousands of CEOs just admitted AI had no impact on employment or productivity · Sasha Rogelberg, Fortune, February 17, 2026

- 2026 Oil and Gas Industry Outlook · Deloitte Insights

- AI in Oil and Gas Market Analysis · Mordor Intelligence

- Energy sector AI spending set to soar to $13B · Energy Capital Media

- BP Capital Markets Update 2025 · BP

- How AI Helps Oil and Gas Investors · DW Energy Group